- Record: found

- Abstract: found

- Article: not found

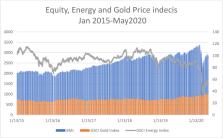

Price and volatility spillovers between global equity, gold, and energy markets prior to and during the COVID-19 pandemic

Read this article at

Abstract

This study sets out to provide fresh evidence on the dynamic interrelationships, at both return and volatility levels, between global equity, gold, and energy markets prior to and during the outbreak of the novel coronavirus. We undertake our analysis within a bivariate GARCH( p, q) framework, after orthogonalizing raw returns with respect to a rich set of relevant universal factors. Under the COVID-19 regime, we find bidirectional return spillover effects between equity and gold markets, and unidirectional mean spillovers from energy markets to the equity and gold counterparts. The results also suggest the presence of large reciprocal shock spillovers between equity and both of energy and gold markets, and cross-shock spillovers from energy to gold markets. Most probably driven by the recent oil price collapse, energy markets appear to have a substantial cross-volatility spillover impact on the others. Our results offer implications for policymakers and investors.

Related collections

Most cited references72

- Record: found

- Abstract: not found

- Article: not found

Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root

- Record: found

- Abstract: not found

- Article: not found

Testing the null hypothesis of stationarity against the alternative of a unit root

- Record: found

- Abstract: found

- Article: not found