- Record: found

- Abstract: found

- Article: not found

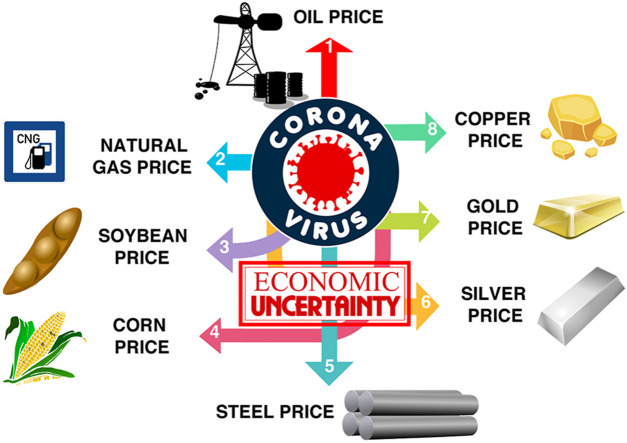

COVID-19 pandemic and economic policy uncertainty regimes affect commodity market volatility

Read this article at

Abstract

This paper investigates the switching effect of COVID-19 pandemic and economic policy uncertainty on commodity prices. We employ Markov regime-switching dynamic model to explore price regime dynamics of eight widely traded commodities namely oil, natural gas, corn, soybeans, silver, gold, copper, and steel. We fit two Markov switching regimes to allow parameters to respond to both low and high volatilities. The empirical evidence shows oil, natural gas, corn, soybean, silver, gold, copper, and steel returns adjust to shocks in COVID-19 outcomes and economic policy uncertainty at varying degrees––in both low volatility and high volatility regimes. In contrast, oil and natural gas do not respond to changes in COVID-19 deaths in both regimes. The findings show most commodities are responsive to historical price in terms of demand and supply in both volatility regimes. Our findings further show a high probability that commodity prices will remain in low volatility regime than in high volatility regime––owing to COVID-19-attributed market uncertainties. These findings are useful to both investors and policymakers––as precious metals and agricultural commodities show less negative response to exogenous variables. Thus, investors and portfolio managers could use precious metals, viz. Gold for short-term cover against systematic risks in the market during the period of global pandemic.

Graphical abstract

Related collections

Most cited references37

- Record: found

- Abstract: found

- Article: not found

COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach

- Record: found

- Abstract: found

- Article: not found

The contagion effects of the COVID-19 pandemic: Evidence from Gold and Cryptocurrencies

- Record: found

- Abstract: not found

- Article: not found