- Record: found

- Abstract: found

- Article: found

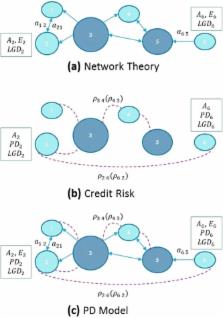

A dynamic approach merging network theory and credit risk techniques to assess systemic risk in financial networks

Read this article at

Abstract

The interconnectedness of financial institutions affects instability and credit crises. To quantify systemic risk we introduce here the PD model, a dynamic model that combines credit risk techniques with a contagion mechanism on the network of exposures among banks. A potential loss distribution is obtained through a multi-period Monte Carlo simulation that considers the probability of default (PD) of the banks and their tendency of defaulting in the same time interval. A contagion process increases the PD of banks exposed toward distressed counterparties. The systemic risk is measured by statistics of the loss distribution, while the contribution of each node is quantified by the new measures PDRank and PDImpact. We illustrate how the model works on the network of the European Global Systemically Important Banks. For a certain range of the banks’ capital and of their assets volatility, our results reveal the emergence of a strong contagion regime where lower default correlation between banks corresponds to higher losses. This is the opposite of the diversification benefits postulated by standard credit risk models used by banks and regulators who could therefore underestimate the capital needed to overcome a period of crisis, thereby contributing to the financial system instability.

Related collections

Most cited references40

- Record: found

- Abstract: not found

- Article: not found

On the Pricing of Corporate Debt: The Risk Structure of Interest Rates

- Record: found

- Abstract: not found

- Article: not found